Mahadev Satta App Case: Big investment made in stock market in name of 17 dummy companies?

2 min read

Raipur(Team Newsbuddy): In the Mahadev Satta App case, the Enforcement Directorate (ED) on Wednesday filed a third supplementary chargesheet of more than 2000 pages in the Special PMLA Court in Raipur. The chargesheet includes the names of 8 accused and 17 companies related to betting hawala transactions.

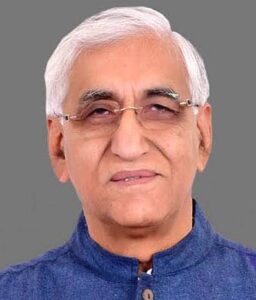

Apart from this, in the chargesheet, the ED has declared Harishankar Tibrewal, Sandeep Modi, Kamal Kishore, Prashant Bagri and two other accused absconding. It has also been told that Suraj Chokhani and Girish Talreja are already arrested. It has also been told quoting sources that the accused Tibrewal is the major partner of the betting app Sky Exchange of Mahadev app promoter.

It is alleged that he invested the money earned from Sky Exchange in the stock market through 17 Indian dummy companies and offshore companies. These dummy companies worked under the direction of Tibrewal’s close associate and arrested accused Suraj Chokhani.

Names of these companies included in the charge sheet: ED has included the names of 17 companies in the charge sheet. These companies are involved in laundering black money of betting in the stock market through Sky Exchange.

01) M/s Ability Games Private Limited

02) M/s Ability Smartech Private Limited

03) M/s Ability Ventures Private Limited

04) M/s Brilliant Investment Consultants Private Limited

05) M/s Discovery Buildcon Private Limited

06) M/s Forest Vincom Private Limited

07) M/s Swarn Bhoomi Vanijya Private Limited

08) M/s Dream Achievers Consultancy Private Limited

09) M/s Ecotech General Trading LLC

10) M/s Caterfield Global DMCC – (Dubai based company)

11) M/s Plus Commodities DMCC – (Dubai based company)

12) M/s Zenith Multi Trading DMCC (Dubai based company)

During the ED investigation, it has been found that Rs 423 crore was diverted to the stock portfolio allegedly on the instructions of Tibrewal till February 29. According to the ED, most of these investments were in small and midcap stocks.

The ED has identified and seized Indian companies holding securities worth Rs 580 crore in the stock portfolio under the control of Tibrewal and his associates. It has also been found that foreign entities also invested in India through FPI.

The ED investigation has also found evidence of investing the income from betting business in the stock market directly or indirectly in these companies. An Excel sheet has also been recovered. In this, these companies converted betting funds into bank entries with the help of professional entry operators. This was done to obtain bank balance in bank accounts.

According to the ED’s supplementary charge sheet, the arrested accused Girish Talreja is a hawala operator from Bhopal, who is the promoter of Lotus 365. ED investigation has revealed his connection with Bhopal’s Shubham Soni and Ratanlal Jain. Big transactions worth crores of rupees have been detected between Shubham Soni, Pradeep Talreja and Ratanlal Jain. Investigation has revealed that Pradeep Talreja is also one of the promoters of Mahadev betting app.