Removal of GST from insurance premium in budget demanded:AII

2 min read

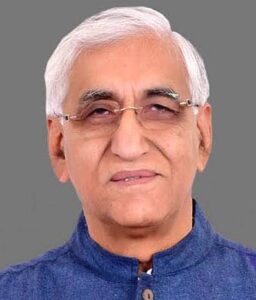

Union handed over memorandum to MP Brijmohan

Raipur(Team Newsbuddy) : Requesting to raise some major problems of Indian insurance market effectively in the Parliament, a delegation of insurance workers met Raipur Lok Sabha MP Brijmohan Agarwal at his residence and handed over the memorandum. It is noteworthy that the All India Union of Insurance Workers (AII) has formed a committee to deal with the problems of insurance market in the Parliament. On the call of the organization All India Insurance Employees Association, before the budget session of the Parliament, a delegation of Surendra Sharma, Rajesh Parate, Atul Deshmukh, Gajendra Patel, Subhash Sahu, Lalit Verma and Deepak James, led by CZIEA General Secretary Dharmaraj Mohapatra, met the MPs across the country and submitted a memorandum to take the initiative of making a provision in the budget to abolish 18% GST on life and health insurance. The memorandum mainly demands removal of GST from life and health insurance premiums, attractive provisions in income tax exemption for insurance policy holders, integration of all four nationalized general insurance companies and stopping the disinvestment of LIC. It has been said in the memorandum that 18% GST on life insurance and health insurance premiums is putting a heavy burden on policy holders and this can affect the growth of business. The Parliamentary Committee formed under the leadership of former Union Minister Jayant Sinha has also recommended rationalization of these rates. Therefore, there is a need to withdraw GST from insurance premium in this budget. In India In view of the declining domestic savings, it is necessary to promote savings through life insurance and therefore, income tax exemption should be increased by making attractive provisions for insurance premiums in the budget. The premium collected through life insurance provides the government with a lump sum amount for long-term investment, which is invested in the development of the country’s infrastructure sector. Similarly, the four companies of the nationalized General Insurance Corporation need to be integrated and strengthened so that they can be more capable of competing with private companies instead of competing with each other.